How to Navigate the 2020 Election with Your Advertising Budget

As the 2020 presidential election draws near, media companies and analysts are starting to publish estimates regarding the spend of political advertisers. In turn, marketers are logically asking their media agencies to prepare for how this will affect their advertising campaigns. While several unknown factors will influence how political candidates spend their 2020 media budgets, understanding the trends will help advertisers navigate the best approach during this time.

According to The Center for Responsive Politics, presidential political campaigns have spent $2.4-$2.8 billion during each of the last three election cycles. Combine this with Congressional funding and the number totaled $6.5 billion in 2016.

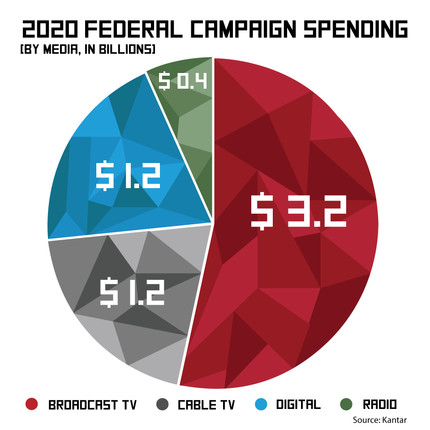

According to Kantar, a leading research firm that tracks advertising spending across multiple media types, approximately 60% of campaign budgets flow to paid message delivery.

In the last decade, the highest increase in presidential spending occurred in 2008 compared to 2004. If we assume the same rate of increase demonstrated from 2004 to 2008, Kantar suggests that total political advertising spend for the 2020 cycle could result in $6 billion in paid political advertising spend.

Advertisers should be mindful that this is an election year, but the extent to how this will affect their campaign performance and scheduling will vary depending on geography, media mix and timing.

Geography

The majority of political spending occurs at the local level, particularly in battleground states such as Florida, Indiana, Iowa, Missouri, Nevada, North Carolina and Pennsylvania as well as swing states such as Wisconsin, Michigan and Arizona.

According to Kantar, only 30% of the 2016 GOP presidential primary spending was on national TV, predominantly towards Fox News, MSNBC and CNN.

Media Mix

Some mediums will become more saturated than others during the election and events that surround it. While political spend may be increasing in certain areas, it is important to understand these increases in context with advertising spend trends as a whole.

Traditional Television

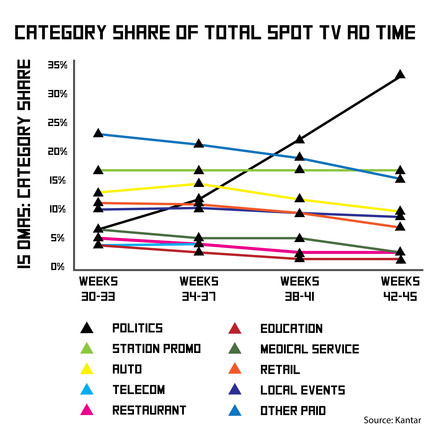

The majority (73%) of political spending occurs in television, specifically in local broadcast and local cable inventory. At its peak in the three weeks just before the election, political ads heavily saturated this medium in 2016, representing a 32% share of spot TV ad time within the top battleground states and, consequently, reduced non-political ads down to a 51% share. Station program promotions made up the difference.

Video

Over-the-top (OTT) television viewing including connected TV digital buys are trending upwards in general for advertisers as television habits are shifting. While traditional television will remain the lion’s share of political ad dollars, increases to OTT spend are likely. Many hope that the growth in connected TV digital viewership will offset inventory demands. According to eMarketer, connected TV usage in the U.S. will grow 5.3% to reach 195.1 million viewers (all ages) by the end of this year, surpassing 200 million in 2020.

Digital

In 2020, Kantar expects $1.2 billion will go to digital. This is roughly 2% of total digital ad spending in the U.S. according to a GroupM report referenced by the Wall Street Journal and only 1% of total digital ad spending according to eMarketer. There’s a lot of speculation around digital. Most of the predictions on digital spending are using averages of where past candidates landed with their digital spend and this varied greatly by candidate. In 2016, Clinton spent 6%, Sanders spent 12.5% and Trump spent 40% of their media budgets on digital, according to Kantar. Regardless, any major increase in digital spend by political campaigns will likely not out-trend the expected 19% increase in advertising spending towards digital as a whole next year. Even if 2020 was not a political year, marketers should be savvy that CPMs (cost per thousand impressions), cost per clicks and cost per conversion metrics in digital are more likely to be affected year over year due to the growing competition for digital inventory from all advertisers combined than from political advertisers alone. Given the nuanced targeting available in most digital platforms, competition varies by target audience. Timing for digital will also follow standard trends more so than election cycles. The flexibility of digital gives advertisers the opportunity to adapt and optimize.

Timing

In 2019, minimal political ad spending had occurred outside of Facebook and Google for the presidential campaign. As we kick off 2020, we are starting to see big spending as the race heats up.

Even with the unprecedented advertising that has kicked off this year, analysts predict political ad spending will be at its heaviest in the 16 weeks leading up to the election within the battleground states. At the start of this time frame, political share of spot TV ad time has historically been at 6% and increased to 32% by election date. Again, this pertains mainly to local inventory. National TV inventory is historically less saturated.

Advertisers that rely on local media in battleground states are best to steer clear of local TV during the 8-16 weeks prior to an election if business allows. This is when local TV inventory is most constrained. For advertisers that must be on local TV during this time frame, it is important to book early at least 3 months in advance and to do thorough research on unit and cost-per-point values in the market in order to understand rates by class. The Media Audit offers a helpful explanation on the rules for preemption by political advertisers. Regarding the “lowest rate” regulation, political candidates are entitled to the lowest unit rate in the class of time they are purchasing during political protection periods only. These periods are 45 days prior to a primary and 60 days prior to a general election.

How and to what extent your marketing campaign will be affected by this year’s election comes down to geography, media mix and timing. By diving into the media landscape, marketers can restore confidence in their approach and, where needed, proactively adapt to deliver efficient and effective results in 2020.

Need help navigating your paid media this election year? Hoffman York is a full-service advertising and marketing communications agency with experience helping clients succeed. HY provides award-winning creative solutions, paid media, content creation and public relations, as well as research and analytics. To learn more about how HY can help your brand succeed, contact us at ROI@hoffmanyork.com. Or, click here to see a gallery of our work.